The Top Features to Look for in a Secured Credit Card Singapore

The Top Features to Look for in a Secured Credit Card Singapore

Blog Article

Introducing the Possibility: Can People Discharged From Bankruptcy Acquire Debt Cards?

Understanding the Influence of Insolvency

Upon declaring for personal bankruptcy, people are challenged with the significant effects that permeate numerous elements of their economic lives. Personal bankruptcy can have a profound impact on one's credit report, making it challenging to access credit scores or fundings in the future. This monetary stain can remain on credit history reports for numerous years, affecting the person's capability to secure favorable rate of interest or economic chances. Additionally, personal bankruptcy might lead to the loss of properties, as specific ownerships might require to be sold off to pay back financial institutions. The emotional toll of personal bankruptcy should not be taken too lightly, as people might experience sensations of pity, anxiety, and regret as a result of their financial situation.

Moreover, insolvency can limit work chances, as some employers perform credit rating checks as part of the hiring process. This can present a barrier to individuals seeking new task leads or job improvements. On the whole, the impact of insolvency prolongs beyond economic restrictions, affecting different aspects of a person's life.

Aspects Impacting Credit History Card Authorization

Obtaining a credit card post-bankruptcy is contingent upon various crucial aspects that dramatically affect the approval process. One important element is the candidate's credit report. Following bankruptcy, individuals usually have a reduced credit history as a result of the negative effect of the personal bankruptcy filing. Bank card companies typically look for a credit history that demonstrates the applicant's capacity to handle credit history sensibly. An additional important factor to consider is the candidate's revenue. A secure income assures bank card issuers of the person's capability to make timely repayments. Additionally, the size of time given that the insolvency discharge plays an important function. The longer the period post-discharge, the more positive the possibilities of authorization, as it indicates monetary stability and accountable credit score actions post-bankruptcy. Furthermore, the kind of charge card being used for and the company's certain needs can additionally influence authorization. By thoroughly considering these aspects and taking actions to restore credit score post-bankruptcy, individuals can improve their potential customers of obtaining a check charge card and working in the direction of content economic healing.

Steps to Rebuild Credit History After Bankruptcy

Restoring credit rating after personal bankruptcy calls for a critical strategy concentrated on economic technique and regular debt management. One effective approach is to get a guaranteed credit scores card, where you deposit a certain quantity as security to establish a credit limit. In addition, take into consideration ending up being a licensed user on a family members participant's credit score card or checking out credit-builder financings to additional improve your credit history score.

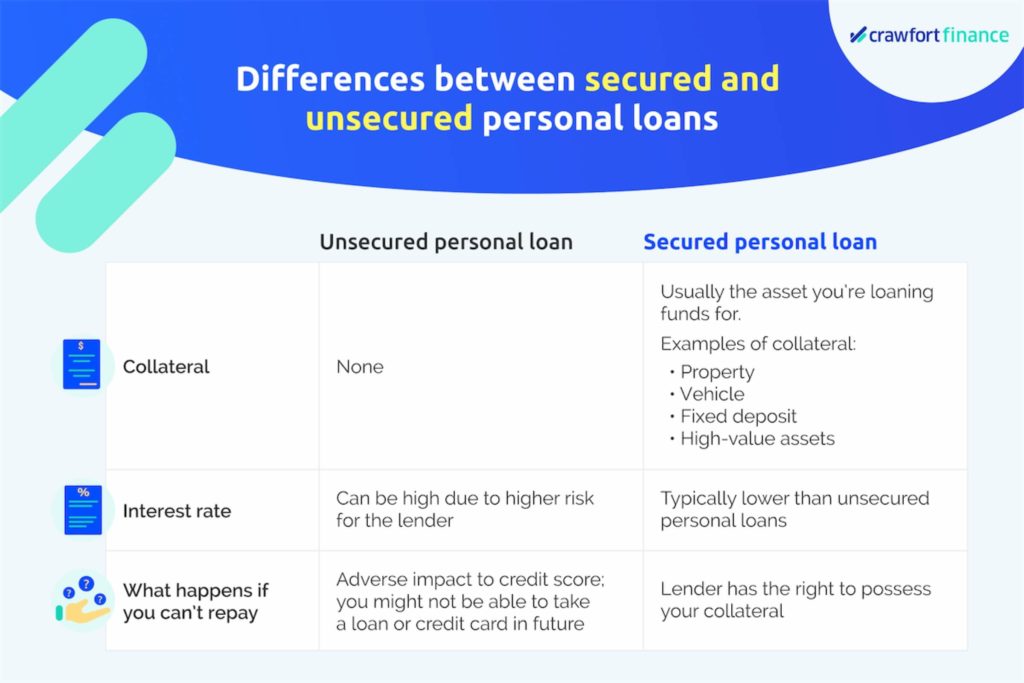

Guaranteed Vs. Unsecured Debt Cards

Following personal bankruptcy, individuals typically consider the choice between protected and unprotected credit report cards as they aim to restore their creditworthiness and financial security. Safe credit history cards need a cash money down payment that offers as security, typically equal to the credit limitation granted. Ultimately, the choice in between safeguarded and unprotected credit history cards need to align with the individual's economic purposes and capability to manage credit history properly.

Resources for Individuals Seeking Credit Score Rebuilding

One important resource for individuals looking for credit score restoring is credit rating therapy agencies. By functioning with a credit report therapist, people can get understandings into their debt records, learn strategies to increase their credit ratings, and obtain support on managing their check my site finances effectively.

An additional practical resource is debt surveillance services. These solutions permit individuals to keep a close eye on their credit records, track any type of mistakes or changes, and detect possible signs of identification burglary. By checking their credit score consistently, people can proactively address any type of issues that might develop and ensure that their credit report information is up to day and precise.

In addition, online tools and sources such as credit rating simulators, budgeting apps, and financial proficiency sites can give individuals with beneficial information and devices to assist them in their debt reconstructing trip. secured credit card singapore. By leveraging these sources properly, people released from bankruptcy can take meaningful actions in the direction of improving their credit rating health and wellness and securing a better monetary future

Conclusion

In final thought, people released from personal bankruptcy may have the opportunity to acquire bank card by taking steps to rebuild their credit report. Variables such as credit scores income, debt-to-income, and background ratio play a significant role in charge card approval. By comprehending the impact of insolvency, choosing between safeguarded and unsafe bank card, and making use of sources for debt restoring, individuals can improve their creditworthiness and potentially acquire access to charge card.

By working with a credit report counselor, individuals can acquire understandings right into their credit score records, find out strategies to boost their credit history scores, and get support on managing their funds efficiently. - secured credit card singapore

Report this page